We know they have all taken a hit recently, so we’re taking a long-term view; we’re looking over twenty years!

The Reserve Bank of NZ’s latest report on housing shows the average return over twenty years is 10.9% – higher than Kiwisaver, Shares and other popular investments. So, we’re calling housing the winner!

“The current level of investment in housing can be explained given its relatively robust financial returns over the past two decades.” – RBNZ

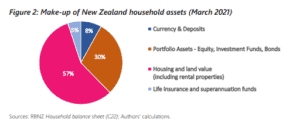

57% of Kiwi’s assets are in housing, of which around 2/3 is owner-occupied, and 1/3 is investor owned.